How much does it cost you to acquire a new customer? Most security companies don’t really know – but they should. If you’ve ever seen an episode of “Shark Tank”, one of the most common questions from the Sharks is: what’s your customer acquisition cost? It’s a key metric for any business, and one you should know and review at least quarterly.

Customer Acquisition Cost and LTV: Yin and Yang

In our last blog post, we explored Lifetime Value of a Customer, or LTV. In this post, we’ll explore Customer Acquisition Cost, or CAC. These two are the yin and yang of your company’s ability to create value.

CAC Defined

Wikipedia explains:“CAC is the cost of winning a customer to purchase a product/service. With CAC, any company can gauge how much they’re spending on acquiring each customer. It shows the money spent on marketing, salaries, and other things to acquire a customer. Keep an eye on CAC so it doesn’t get out of control. For example, no rational company would spend $500 to acquire a new customer with an expected LTV of $300 because it would drain $200 of value per customer acquired.”

That explanation is precisely why CAC is so important! What we all want in building our businesses is to create value over time; that can only happen when CAC < LTV.

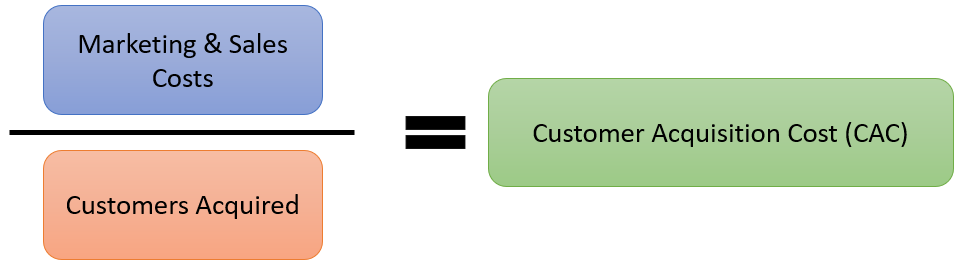

For those of you who want to see the math, here it is:

Identifying Your Customer Acquisition Cost Items

Obviously you will need to review your expenses and investments to determine your total dollars spent to acquire customers. Typical CAC items would include:

- Sales salaries, benefits, bonuses, commissions

- Marketing/website expenses

- Advertising

- Travel & entertainment, sales events

- Sales support, CRM costs

- Allocation of overhead

- Any subsidies or discounts of the upfront cost (loss on install)

The last item above is typical for “dealer program” sales programs, where the system is offered at zero or $99 down. That requires a loss be taken upfront, which is then (hopefully) recovered through a higher-rate long-term contract. In those programs, CAC is usually called “creation cost” in our industry. Much has been written about these programs. Some have succeeded, most have not. The CAC we’re discussing in this post relates to the more traditional dealer installing custom systems with a positive upfront margin.

An Average Customer

All customers are not created equal. A $25,000 commercial access control system does not resemble a $1,200 standard residential installation. As explained in our LTV post, you’ll need to look at ALL your CAC dollars and ALL your customers acquired over a period of time—every quarter is probably a good time frame, and for each fiscal year.

You should be able to easily come up with the DOLLARS SPENT using your G/L software (usually QuickBooks) and your CUSTOMER COUNT to solve the CAC equation. The count will need to use your average RMR per customer. So if your average RMR per customer is $45 and you added $900 in RMR during the quarter, you added 20 “average” customers. Good customer management software—like Cornerstone’s—can get you the count in a few seconds.

Adding It All Up

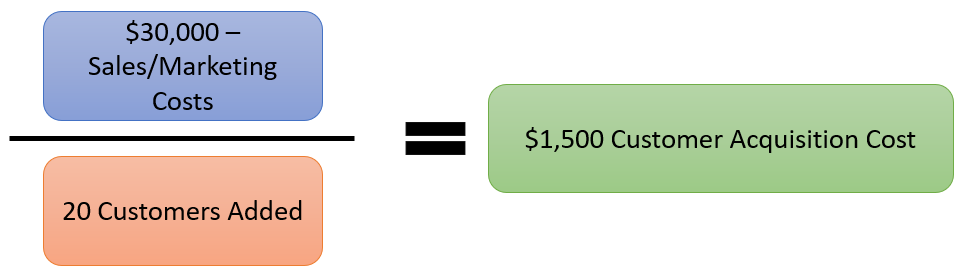

QuickBooks allows you to set up and SAVE custom reports. Let’s say you’ve build a custom report that has all your sales and marketing expenses for the numerator of your CAC equation. You run it for the last quarter, and see that total expenses were $30,000. Using the prior example of 20 customers added, here’s the result:

Why This is Important

From our August post on LTV, we built an example where the lifetime value of a subscriber was about $3,500

So the bottom line is this: your company WOULD BE CREATING VALUE, because it cost you $1,500 to create customers that had a lifetime value of $3,500+.

Needless to say—this is extremely useful!

What is a GOOD LTV:CAC Ratio?

So what is considered a “good” ratio? In our example, the LTV / CAC ratio is about 2.3x. That sounds pretty good to me, the return on investment is over 2x. Here’s what our experts at Wikipedia say about it:

- 3:1 is a very good level because the customer relationships are solid and customers are acquired for the right price.

- higher than 3:1 means the company has untapped growth potential to acquire customers.

Other experts say 3:1 is too low, that we often don’t include all the expenses we should be. What you invest in sales/marketing may depend on how competitive your market is, how tight cash flow is, and other factors. But understanding your CAC, and looking at it regularly, is an awfully good start.

Cornerstone Billing Solutions is the leading provider of comprehensive billing services and powerful account management software for security alarm dealers nationwide. Call us at 224-577-1197 to learn how Cornerstone’s affordable and time-saving billing services, superior dealer support, and specialized, cloud-based software can help your business improve efficiency and profitability.