In Parts one and two, we outlined a simple model that helps to easily understand how you’re doing, and to set minimum sales & margin levels based on your goals. This final post will cover owner compensation, followed by a look at how a “zero overhead” view of your financials can reveal your true margins.

Getting Paid Last?

Any business owner should understand that the business comes first. For my own business, I always assume that I am the last to be paid – our employees, suppliers, lenders, and the government come first. Once those are covered, I consider two things – what I’d pay a hired gun to run things, and what the business can afford to pay me.

Market Compensation

Once a business is past the startup phase, there should be enough profit to pay the owner at least “market compensation”. That amount is subjective, but think of it as the cost to bring in a hired gun to run the company. Pay level would be comparable to that of a division manager for a larger business.

Let’s say you could bring in a CEO for $100,000 to take your place. That’s a starting point for determining a fair pay level from the business. But it’s also understated, because it ignores a) the big risk you took establishing the business, and b) the below-market pay you got in the early years of the business.

Paying vs Retaining Earnings

If your company’s net profit before owner pay is $200,000 in this example, you could pay yourself twice what a hired gun would cost. But should you? If your company is a “pass through” entity like an S corp. or LLC, you may need to distribute earnings in order to pay personal taxes. You may also feel you’ve earned a premium for taking the upfront risk to start or buy the company, and taking below-market wages in the early years.

My own bias is to retain earnings IN our business versus paying it as compensation. Why? Because a financially healthy business is the golden goose. Keeping the goose healthy is job one. If I choose to retain $100,000 of profit in the business instead of paying it out as salary, I’ve added to our base of equity. Growing the equity base creates many good options, such as:

- Helping the company easily weather a deep recession

- Supporting a strategic acquisition

- Investing in software and/or services that streamline the business

- Enabling a key hire or two

- Supporting performance bonuses to the team

- Enabling a future distribution to the owner(s)

The last item above may be most important. You can always distribute retained earnings in the future. Why not retain a few more dollars in the business right now, so you have dry powder for whatever opportunities – or misfortunes – could arise?

What If?

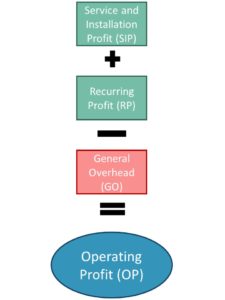

Here’s a refresher on the simple model I outlined in Part 1 of this series:

Let’s say your SIP averages $15k/month, your RP averages the same, and your GO is $25k. So your OP is about $5k/month, $15k + $15K – $25k = $5k. Let’s now pose a BIG question: what would your overhead be if you shut down your SIP division and focused ONLY on maintaining your recurring account base?

For most established and growing security companies, most of their General Overhead would go away. They wouldn’t need nearly as many techs, no sales staff, and no need for the admin staff that supports scheduling & field techs, no trucks, no sales staff, etc. Say $20k of the $25k in GO would disappear in maintenance mode.

The Reveal

In this example, a key fact emerges: the SIP division is losing money. By forcing an “allocation” of the $25k in overhead to each division, here’s what you get:

- RP of $15k minus $5k in ‘maintenance’ overhead = $10k in profit

- SIP of $15k minus $20k in ‘allocated’ overhead = loss of $5k

For many established security companies, this is more than a mental exercise – it’s what’s actually happening. The recurring cash cow earnings is subsidizing losses in the S & I division – where the growth is driven. Is this OK? It’s fine if the owners know it’s happening. They may be deciding that the new recurring being generated by adding new accounts – at an affordable monthly loss – is worth it to build the recurring margin.

Even Simpler

In fact, if you take your usually predictable monthly overhead, and allocate it every month to your two profit centers (SIP and RP), you’ll have your Net SIP and Net RP (net of allocated overhead). Forcing this allocation reveals the true contribution to your all-important Operating Profit. If you find your Net SIP is too low or a net loss, you’ll be able to focus on the improvements you need in order to fix it. That could mean more careful quoting, improving your labor utilization (revenue minus cost per labor hour), or many other things.

Getting Better

Security companies that struggle to make a profit can usually trace the problem to Net SIP that’s underwater. And this is likely occurring due to labor inefficiencies – too much wasted time during the day due to paper-based service tickets, inadequate inventory tracking, quotes that don’t build in enough margin, and so on.

That’s why real-time, mobile-device-based management of field service and installations is becoming so popular. It’s driving improved labor efficiencies, which pays off big. Our base of security dealers is increasingly taking advantage of our cloud-based service tickets, inventory, billing, and payment features. Managing your field service work in real time, then billing and getting paid immediately, is becoming a must.

Are you investing to keep up with your competitors?