Most of the office managers we work with would rather have a root canal than try collecting money from past-due customers! It’s stressful to put pressure on customers you worked so hard to find and win. Well, Cornerstone has a solution that takes the pressure off.

Cornerstone’s Solution – Billing Plus!

Our Billing Plus service creates an autopilot for managing your past-due accounts. It includes five customer touches every month:

- Texts

- Emails

- Automated calls

- Collection letters

- Statements

These touches happen like clockwork, month after month until the bill is paid. It’s the squeaky wheel concept—with constant reminders using different methods (text, email, paper). Subscribers quickly get the message—it’s a hassle if you don’t pay on time!

Effective Collections Means Following Through

Effective collections is a lot like good parenting—set clear limits, then follow through! The customer has agreed to pay for recurring security/fire/PERS services on a periodic basis. If they fail to hold up their end of the bargain, a consistent process is essential to getting them current. Here are our key recommendations:

Good Alarm Company Software Generates Good Invoices

Effective collections starts with good invoicing—that can help avoid past due accounts in the first place. Quality security account management software will include rock-solid recurring billing processes. In Cornerstone’s system, recurring billing is built into our security company management software. When we run recurring billing batches, the invoices are crystal clear, and include all the specifics:

- Service being billed (e.g. monitoring)

- Service period (e.g. a quarter April 1, 20xx – June 30, 20xx)

- Charge for that service (e.g. $100.00)

- Any taxes on the service (e.g. $6.00)

- Due date for the invoice (e.g. April 1, 20xx)

- How to pay the invoice (send in tear off stub and mail, pay online, call company to pay)

Why is it so important to include all this? Customers forget exactly what services they signed up for. They may forget the billing cycle they agreed to. So if your software doesn’t include those specifics, you’ll end up getting inbound calls—unnecessarily. That costs you time and money. The subscriber may simply decide to delay payment, rather than calling, because they aren’t clear about the bill. Make sure to include prior unpaid amounts on invoices, so the customer sees 100% of what they owe. That makes it more likely they’ll pay 100% of what they owe.

Alarm Company Software Makes it Easy to Pay

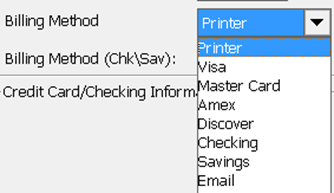

These days, automatic payment methods (autopay) are the most common way for subscribers to pay. Make sure you offer ALL options—paper check, credit card, checking or savings debit, or online payment. Cornerstone’s system includes our portal, Alarmpayments.com, which has become a very popular site, processing about $2 million per month in recurring and non-recurring payments. Our paper invoices, and statements to past dues, include an easy-to-use tear-off stub with a return window envelope. Easy!

Be Early and Consistent in Collections

The due date is the trigger, though a short grace period after that date is wise. Cornerstone starts our activities 10 days past due. Any good collector knows that starting early, along with dogged persistence, is the key to getting paid. Our Billing Plus service works because it is consistent. A subscriber can ignore an email, or a call. But it’s not easy to ignore a paper letter or paper statement clearly stating that they’re past due.

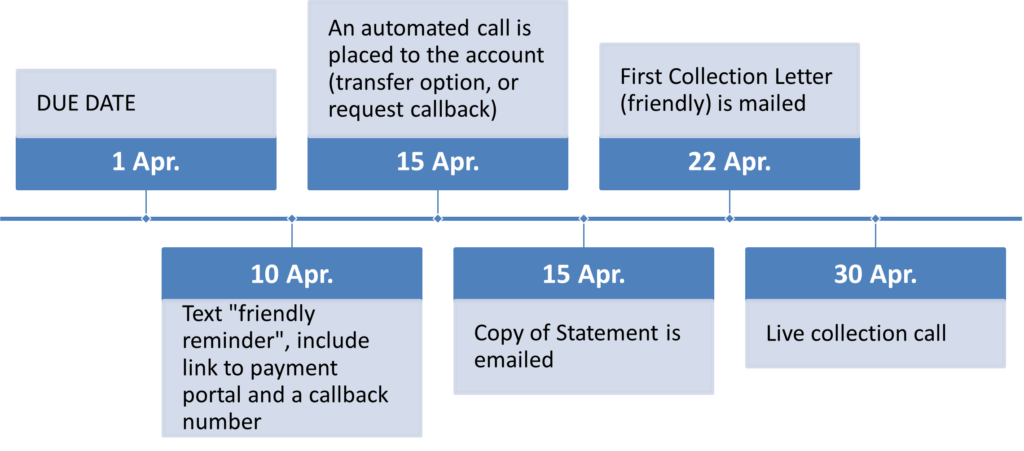

Timing of Collections Touches

What’s the best timing of various ‘touches’ to get the customer caught up? Below is a typical collections process, using a calendar month where the due date is the first of the month:

Our Billing Plus service starts with texting. Especially for younger subscribers, texting is very effective—especially if a payment link is included with the text…ours do. The next step is usually an automated call, which can be recorded by the person in your office that normally makes collection calls. The wording of that message is important—Cornerstone has perfected the messaging over our 16+ years offering Billing Plus.

Next steps are usually an emailed statement, followed a few days later by a paper statement. The timing of these can vary a bit, based on when Cornerstone runs a dealer’s billing batches. About 3 weeks past due, a collection letter is mailed—if all other methods fail, a paper letter is effective. Finally, if an account is 30-days past due, we recommend that our customers intervene to make a live collection call, if they are able.

Increasing Urgency in Collections

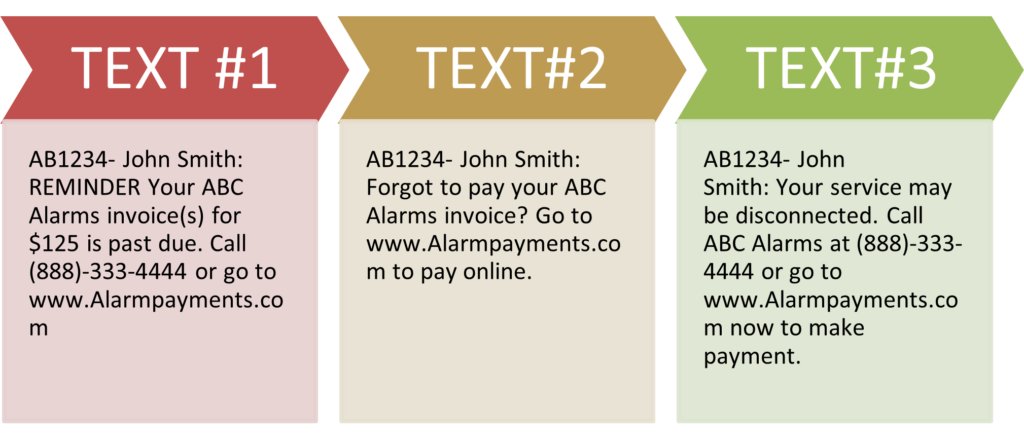

Each month an account gets further past due, we carefully ramp up the urgency of all the messages being sent. The wording used is professional, but very direct. As a subscriber approaches “cutoff” of services, there are clear warnings to the subscriber.

Below are examples of text messages used at 10 days, then 40 days, then 70 days past due. Note the increasing urgency and clear call to action:

We work with our customers to both use the most effective language for each type of message delivery method, and to customize those messages as needed. Timing, tone, specific wording used, and clear calls to action are key to getting your subscribers to act. We’ve built our best practices to help you get this right.

Push Autopay – Especially Bank Debit

Our processes nudge slow payers toward autopay, for obvious reasons. On average across all our customers, over 70% of end subscribers have signed up for autopay—credit card or bank debit. Some of our customers have over 90% autopay. The higher the percentage, the less likely significant follow up will be needed for past dues.

You can use “going green” initiatives to help migrate customers to autopay; you can also implement a paper billing fee. By far the best autopay method is ACH debit. For credit card payers, our customers bear a 3% merchant charge—quite expensive! Credit cards are also fairly high maintenance, as 6 – 12% of cards fail to clear, requiring follow up. By contrast, only about 1% of bank debits fail to clear, and the cost to clear an ACH debit is much lower than the credit card merchant fee.

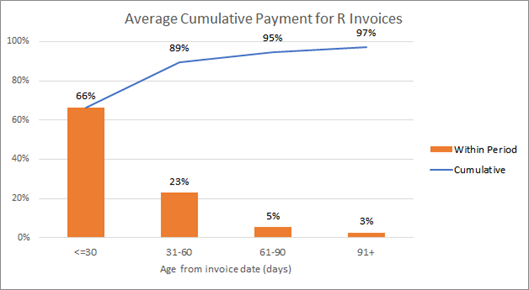

Use a Good Pattern for Recurring Collections

What should a security company expect in terms of when their recurring receivables are paid in full? Due to attrition, they may rarely receive 100% of the billed amount for a given batch, but below is a typical payment history for a recurring batch. You can see that on average about 95% of the billed amount is collected within 60 days of the due date:

Companies with a higher autopay percentage can expect even faster collection rate.

When to Cut Off Collections on an Account?

We leave this up to our customers, but most that use our Billing Plus service start cutting off accounts at about 90 days past due. Our service can send a final 10-day cutoff letter, with USPS delivery confirmation, and including a final opportunity to pay. We have integrated with a collection agency, A.R.M. Solutions, and some of our customers use them to “hand off” seriously delinquent accounts. In most cases, that final cutoff letter CAN come from A.R.M. Solutions—so it’s on collection agency letterhead. That can be very effective at getting paid. Some customers simply write off the balance due or take the balance of contract to a small claims court.

Cornerstone’s Alarm Company Software Can Help!

Our customers are extremely busy, and most dislike the collections process—so avoid it. Cornerstone’s Billing Plus service can very affordably handle this entire process for you. Every quarter, we send a summary report of our collections success to our customers, because we’re proud of our collection rates. Just give us a call, if you think your receivables are too high—we can get them back in line!

Cornerstone Billing Solutions is the leading provider of comprehensive billing services and powerful account management software for security alarm dealers nationwide. Call us at 224-577-1197 to learn how Cornerstone’s affordable and time-saving billing services, superior dealer support, and specialized, cloud-based software can help your business improve efficiency and profitability.