As a small-business owner, you have to prepare for obstacles.

Businesses have to ready for weather related emergencies.

As a small-business owner, you have to prepare for obstacles. Some challenges you can see coming like competition or customer complaints. Certain incidents, like tornadoes and fires, however, can seem to come out of nowhere.

A security dealer has to be ready for natural disasters or other emergencies that could interrupt service or put employees at risk. You need a plan in place to protect your assets and people to ensure business can return to normal after disaster strikes.

Know your risks

Nobody can see the future, but there are certain incidents that are more likely than others. You also have to be aware of the problems that are common for your area or business.

Most regions of the U.S. are prone to certain types of disasters. For example, the San Francisco Small Business Commission said companies operating on the coast of North California have to be ready for earthquakes and tsunamis. All major cities are possible terrorist targets and could suffer from rolling blackouts in warm months. The Midwest has tornadoes, and certain states may get blizzards during the winter months.

Outside of environmental concerns, there are internal hazards that can affect your business as well. Does your company operate out of an old building that could have electrical damage or use heavy equipment that could overheat? Robbery and employee theft are a danger for any company, too. Security dealers have to be ready for any incident that could halt service to clients.

Once you’ve taken stock of all the possible disasters or problems that could strike your business, you have to have a plan in place to prepare for them.

Create a plan

The Federal Emergency Management Agency revealed that more than 60 percent of small businesses don’t have a formal plan for what to do in an emergency, and 75 percent of businesses that don’t have a plan will fail within three years after a natural disaster.

Plans differ for each company operation. As a security dealer, you need to protect your data, equipment and employees. You should prepare to temporarily halt service and have a plan for how to continue after the threat has passed.

If you want to explore options for particular disasters, The U.S. Small Business Administration has a list of links for what materials you need to prepare and what steps to take during each possible emergency.

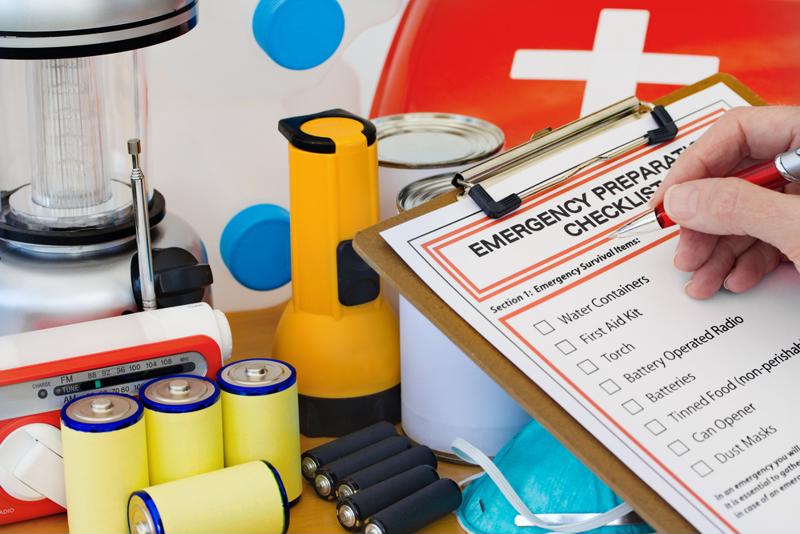

Have the right materials on hand for emergencies.

Have the right materials on hand for emergencies.Insure materials and practices

Insurance is one of your best bets against natural disaster losses. Make sure you review your policy against possible natural disasters in your area. When preparing a policy, it’s a good idea to take pictures of business interiors and expensive equipment for your records.

CapitalOneSpark representative Lisa Wirthman wrote a piece for Forbes magazine suggesting small businesses should acquire property insurance and business interruption insurance. You want to find a policy that covers your company’s loses from halting procedures to overcome natural disaster challenges.

“Radios and mobiles devices are ideal tools for natural disasters.”

Protect employees

Before you protect your finances, you have to have a plan ready for your employees. You have to enforce emergency procedures from day one. Every worker has to know exactly what actions to take during small or major disasters for his or her own safety.

Communication is key. As soon as a single member of company becomes aware of a possible hazard, that person has to communicate the problem to the entire infrastructure. Radios and mobiles devices are ideal tools for natural disasters because they can operate in power outages. If field agents use mobile devices to access alarm dealer software, they are plugged into the company and ready to interact during emergencies.

Back up your data

Employees utilize software on mobile devices using a cloud network. You should look at moving some or all of your business data functions to offsite storage so it is protected during an emergency.

The Internal Revenue Service recommended moving all financial operations to digital options. If a fire breaks out or your location is damaged in anyway, cloud-deployed solutions allow you to access insurance records, customer information and other important documents from multiple devices.

Financial software for security dealers should be a routine part of office procedures to automate processes and simplify record keeping. During an emergency, digital records are more secure and accessible than paperwork.

Resuming security service

Security dealers have unique challenges during emergencies. Security Dealer Magazine said many companies receive false alarms during times of extreme weather. Call center employees have to be trained to respond to customers who panic during emergencies.

Any company offering subscription services has to accommodate billing practices for service interruption due to emergencies or disasters. A security billing software program is flexible. It allows for immediate changes to records and helps business resume immediately after disasters. Customers can receive notifications in their bills indicating what alterations were made during natural disasters or other incidents.